Pros and Cons of Investing in Gold: From Bullion to Mines to Mutual Funds

Gold. Just the word makes dollar signs light up in investors' eyes, especially when we're hearing the news report several times a week that gold is a safe investment - a stable investment in a recession economy - or even, ominously, the best investment during a depression. Nobody wants to take a loss in a troubled economic period, everyone's desperate to get ahead, and the Baby Boomers, who are well on their way to a failing Social Security program, are looking to put their dwindling savings into safe investments for seniors. Gold has been touted as the answer. But is gold really a safe investment? And if it is such a good investment, then why is that so? Could gold be experiencing a "bubble?" Here's a brief outline of the different forms of investment in gold - from physical bars, bullion and coins to gold mining equities and gold mutual funds - and their pros and cons.

The Pros of Investing in Gold

- Even in an unstable economy or during times of political upheaval, gold remains valued and in demand.

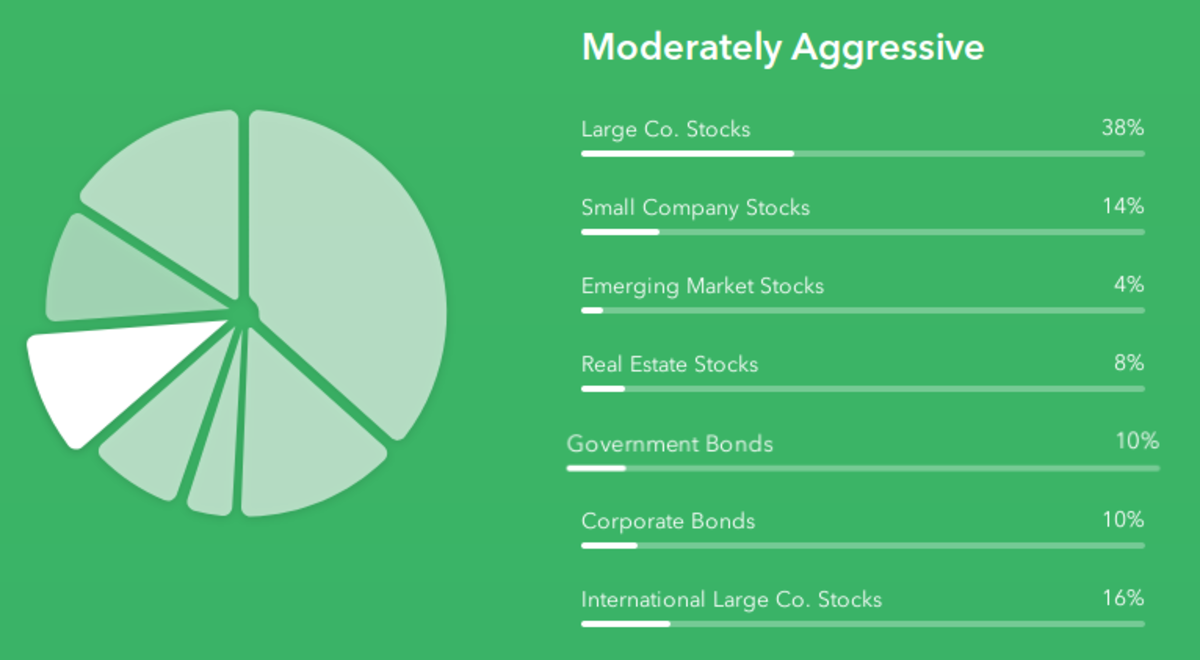

- Gold is an asset-diversifier that helps reduce the overall risk of an investment portfolio. In the last two decades, gold has not been correlated significantly with domestic or international equities, with U.S. Government bonds, equity real estate investment trust, or Treasury bills.

- Some evidence suggests that when equities are hurting and shares fall rapidly, gold's value rises--which is uniquely different from other assets.

- Gold combats the ills of inflation--it's an "inflation hedge."

- Gold is the only asset whose value increases even when the value of the dollar goes down.

- Gold remains a reserve asset at most central banks. Why? Gold is cited as "no one's liability." What this means is that the value of gold is not dependent on economic policies or inflation, and retains its value over the long-term.

- In compliance with the standards set by the London Bullion Market Association, the physical gold that's traded as bars and ingots is at least 995 fine, which means it doesn't tarnish. Gold is durable and lasts.

- Gold's stability relative to other physical assets means it's actually quite cheap to buy. The classic example of the price of a fine men's suit comes from Forbes (1998). The cost of a fine suit of clothes during Shakespeare's time--and for that matter during the Great Depression, or as late as the Reagan era--was about an ounce of gold. Today, a fine suit for men costs well above the price of an ounce of gold--more like 4 ounces.

Cons of Investing in Gold

The cons of investing in gold are minimal, but they should be considered by every investor.

- Like everything else, gold isn't indestructable. It can be lost--as were the vaults underneath in the collapse of the World Trade Center Towers.

- More critically, gold does not earn investment interest. Its use as an investment has historically been more in the way of insurance against a depression or other economic instability than in huge returns. If you look at the National Mining Association's historical chart of gold prices from 1833 to the present, you'll see that gold's price tends toward stability. This may be viewed as a pro by many, but for those seeking wild volatility in their investments, can be considered a con.

Brief Guide to the Methods of Investing

Gold investment can occur in several ways:

Gold investors buy gold as a physical asset (bullion, coins, bars)

Physical gold bullion is traded internationally. It's true that gold as a commodity is not as convenient to invest in as gold as paper (stocks and bonds) or exchange traded funds (gold ETF). You have to transport it and arrange to have it stored...sometimes.

Other times, though, the bullion never leaves its vault. And compared to commodities such as oil, gold is very easy to acquire.

You can purchase gold ingots and bars, gold coins and other forms of tangible gold from a precious metals dealer, a bank, or even through brokerage houses. Read more about the pros and cons of investing in gold as bullion in the Investing in Physical Gold section below.

Investors buy a Gold ETF (Exchange-Traded Fund)

What are ETFs? An ETF is a security that tracks the price of gold throughout the day. Gold exchange traded funds are exclusively devoted to gold and traded on the stock exchange. Buy ETFs through your stockbroker or brokerage account.

An investor participates in commodity trading of gold futures options

Since the Winnipeg Commodity Exchange offered the first gold futures contract in 1972, futures trading has been part of the gold market. Second only to COMEX (Commodity Exchange Inc) in New York is the Tokyo Commodity Exchange (TOCOM). Futures contracts are securities traded at pre-set dates on commodity exchanges. Gold futures options are contracted for the buying or selling of gold at a set price at a specified date in the future. COMEX first offered exchange gold options (options on futures contracts) in 1982. This trading is largely on paper; merely 1% of the gold bought and sold in the futures market ever gets physically delivered. Buy Exchange gold futures options through your brokerage account, or OTC (over-the-counter) options through dealers and banks too.

An investor purchases gold statement accounts or gold plans

Commercial banks or precious metal dealers sell "obligations" to issue gold on demand and in convenient amounts to investors, called gold statement accounts. In these types of obligations, the gold is stored elsewhere until delivered. Offered by some banks, brokerage firms and dealers in precious metals, gold accumulation plans are periodic investments of standard sums. Both statement accounts and gold plans are pooled together with the investments of others.

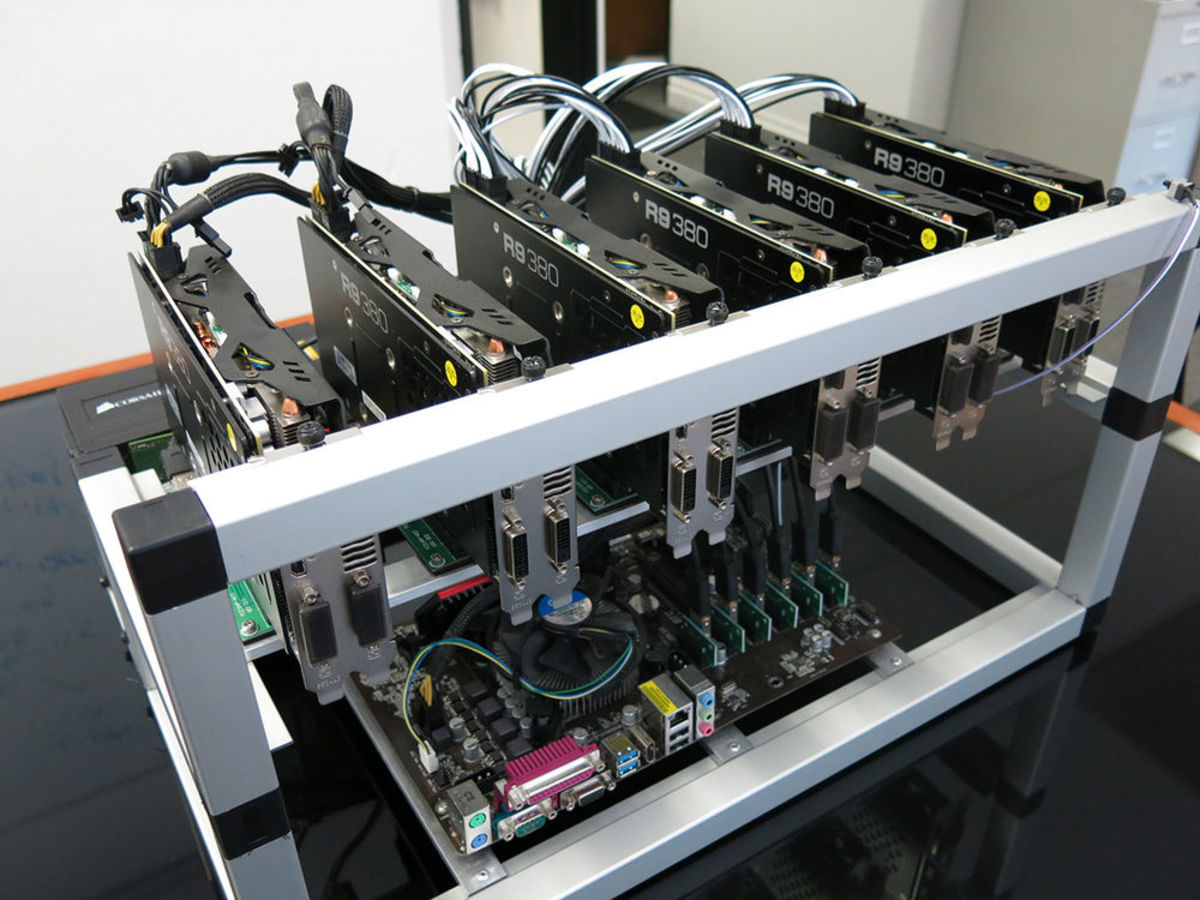

Investors in gold buy shares in gold mines

Investors who already deal in equities often like to purchase gold mining stock shares individually. While the potential capital and dividend rewards can seem attractive, the success of the shares' performance hinges on the success of the gold mine's performance...which can be a con if this is seen as too risky. Buy shares in gold mines through your brokerage account.

Investors purchase gold mutual funds

Gold mutual funds diversify holdings amongst numerous companies, according to type--for example, mixing gold mining stocks--or region, such as those focusing in South Africa, Australia, North America or other regions. Buy gold mutual funds through banks, mutual funds vendors, or a brokerage house.

The Gold Markets: London and New York

Though gold is traded all over the world, two of the most influential markets are in New York and London. The largest market for actual physical gold, London, has been setting the price of gold since 1919. Gold fixing occurs in London twice a day, in mid-morning at 10:30 and mid-afternoon at 3:00. The New York market, the Comex division of the New York Mercantile Exchange, on the other hand, is famous for trading gold on paper.

Investing in Physical Gold: Gold Bullion, Bars, Ingots and Coins

Gold bars are sold in units ranging from 1 gram to 400 troy ounces (London "good delivery" bar) and, commonly in Southeast Asia, Europe and the Middle East, in popular units of 32.15 troy ounces (kilobar).

In China, 5 and 10 tael bars are preferred and in India trading often occurs with 10 tola bars.

Pro: You pay minimal commission to gold bullion brokers - this is a relatively inexpensive way of investing in gold, and transportation costs usually end up being minimal.

Because the market is global, there is typically an opportunity to buy or sell gold at any hour of the day.

For smaller investors, gold bullion coins - coins with a guaranteed gold content that are legal tender of the issuing country can be more convenient.

The monetary value of the coins means less to the bullion coin investor than the value of its gold, which of course fluctuates with the price of gold.

Some popular gold bullion coins are:

- American Eagle Coin (1986-date), of .916 fineness/ 22 karats, sold in 1 troy ounce, half troy ounce, quarter troy ounce, and 1/10 troy ounce denominations

- Canadian Maple Leaf Coin (1979-date), of .9999/24 karats fineness

- South African Kruggerand Coin (1976-present), of .916 fineness

- English Britannia Coin (1987-date), of .916 fineness

- Australian Kangaroo Coin (1989-date), replacing the Gold Nugget Coin, of .9999 fineness

- Chinese Panda Coin (1982-date), of .9999 fineness

- Austrian Philharmonic Coin (1989-present), of .9999 fineness

- Mexican Onza Coin (1981-present), of .999 fineness.

Why is Gold So Valuable and Highly-Sought After?

The value of gold rests on both its beauty and its usefulness.

In the Middle East, gold is commonly bought for investment as well as jewelry. Gold is used not only in jewelry and decoration, but also in dental and medical products due to its non-reactiveness and resistance to bacteria, in air bags, cellular phones, televisions, spacecraft, air bags, and even electronics such as computers and semiconductors, because of its ability, among other things, to conduct heat and electricity, halt oxidation, and remain inert. Gold is even being studied for its uses in pollution control.

Ever increasingly, we need gold in our daily lives, which means good things for those considering investing in gold.

Speculation: The Future of Investing in Gold - Is Gold Experiencing a Bubble?

Some investment advisers and financial planners claim that gold investment is experiencing a bubble that is destined to burst. Others disagree. One thing to consider when speculating on gold's future worth is that the basis for the value of gold may be seen to be experiencing a shift in recent years.

For a long time, the value of gold was stable in large part because gold served a mostly aesthetic function and was universally acknowledged to be desirable. Today, gold is an industrial metal too, with serious application for technology.

This would seem to make it more valuable - and it does, to a degree. However, technology is not a stable thing. Gold's linkage to the growth of technology and the fact that there is (as of yet) no real substitute for gold in the industrial market together mean it is somewhat more volatile an investment than it was historically.

The use of precious metals in manufacturing can make the metal prices volatile. As Pham-Duy Nguyen points out in the June 7, 2010 Business Week article "Gold Futures Jump Most in a Month on Demand for Euro Alternative," the prices of palladium and platinum drop when their use in manufacturing to prevent automobile pollution is anticipated to diminish.

In investment, volatility can be a good thing or a bad thing, depending on the type of investor you are.

Demand for industrial gold can potentially rise and fall. For example, if an industrial substitute for gold is devised, or cell phone device design changes sufficiently, the value of gold can change overnight.

Thus, gold's risk as an investment is hypothetically higher - because if industrial demand diminishes for whatever reason, so does the value of gold.

However, this is complicated by the fact that gold recycling does not occur to the extent it should - which means that the more it is used in technology, the harder it is to recover, and the rarer it becomes.

Along with greater uncertainty comes a greater potential for both losses and profits. In the end, it boils down to the fact that gold does seem to be experiencing a bubble - but it is a bubble with an underlying solid core.

In times of uncertainty - such as when it was announced the U.S. lost 130,000 jobs in July 2010 and the value of the U.S. dollar is declining - gold will probably always represent a safe harbor. Thus it may be a good investment both for the conservative and the speculative investor.

Poll: How Do You Primarily Invest in Gold?

What is your favorite form of gold investing?

Gold Has Historically Been an Investment...as Good as Gold

As you take stock of the advantages and disadvantages of gold mining investments and other "glowing" opportunities to invest in the noblest of the noble metals, keep in mind that trading in gold has been popular since people began recovering the precious metal from the earth, and will most likely continue to be so, profitable or not - because of gold's usefulness and beauty.